Our specialized services expand into France with confidence. At the heart of our approach is exceptional customer service. Effortlessly manage your business with our AI-driven entity management services, tailored for worldwide entrepreneurs. We provide entity management solutions that adapt to your unique business needs in France, like startup visa processing, company formation, tax filings, and compliance, helping your business thrive in France and beyond no legal team required.

Block Chain (South Africa)

Non-Profit Organisation

Beauty Products Trading

Trucking & Logistics

Bol.com trader

Recruitment & Payrolling

Spice & Herbs Export

IT firm

Learn the basics of the French market, including key industries, business practices, and legal requirements. This foundational knowledge will help you make informed decisions as you set up your business in France.

Select the best legal structure for your company in France, whether it's an SARL (Société à responsabilité limitée), SAS (Société par actions simplifiée), or SA (Société anonyme). We'll guide you through the pros and cons of each option to ensure you start on solid ground.

If you're a non-EU entrepreneur, securing a French Tech Visa is crucial. Our AI-driven system simplifies the visa application process, ensuring all forms are accurately completed and submitted on time.

Get your business officially registered with the French Chamber of Commerce and Industry (CCI). We handle the paperwork and legal formalities, making registration a hassle-free experience.

DEAL TYPE: 100% online EXPIRY: No expiry

DEAL TYPE: 100% online EXPIRY: No expiry

DEAL TYPE: 100% online EXPIRY: No expiry

DEAL TYPE: 100% online EXPIRY: No expiry

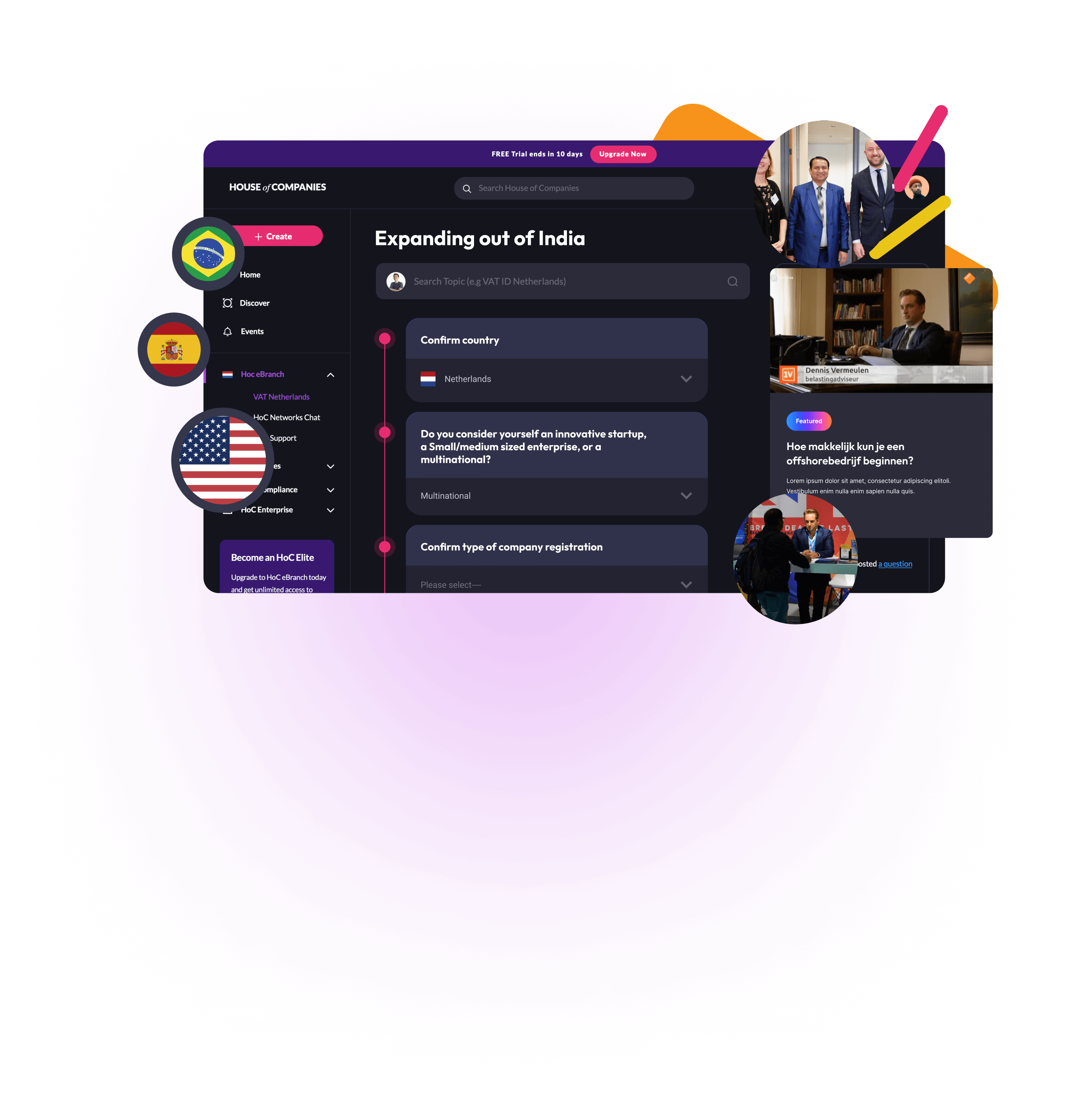

For foreign investors looking to establish their business in France, choosing the right legal entity is a crucial first step. Our customer-focused entity management services make this process simple and straightforward, helping investors from both EU and non-EU countries navigate the complexities of French business law.

The most popular and flexible entity for foreign investors in France, the SAS offers limited liability and flexibility. We handle the incorporation process, ensuring that your company meets all French legal and tax requirements.

We provide complete tax registration services, including VAT setup, to ensure your business complies with French tax laws. Our automated solutions streamline tax filings, keeping your business compliant without the hassle.

For businesses looking to expand into France without forming a separate legal entity, setting up a branch office can be an ideal solution. We assist with all necessary registrations, compliance, and legal processes.

If you're a non-EU entrepreneur, securing a French Tech Visa is essential to launching your business in France. Our team simplifies the application process, helping you submit accurate forms and documentation for a successful visa application.

A subsidiary operates as an independent entity from the parent company. We assist foreign investors in establishing a subsidiary in France, ensuring full compliance with local laws and tax obligations.

Accurate bookkeeping and payroll management are critical for business success in France. We offer comprehensive bookkeeping services, ensuring your financial records are in order, and payroll compliance is met, so you can focus on growing your business.

Register a branch of your current company in France and other EU countries

Complete your residency application for France with our expert help

Get our assistance to submit your Corporate Tax Return in France

Find a Facilitator, Write a Business Plan, and Start your Application with our guidance

€295 py . 00

*Your corporate agent

€995 py . 00

*Unlimited transactions

€550 py . 00

*Ex. government fees

When it comes to establishing and managing your business in France, our comprehensive entity management services stand out as the ideal choice for entrepreneurs worldwide, including those from non-EU countries. We offer a unique blend of expertise, automation, and personalized support that simplifies the complexities of setting up and growing a business in the French market.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!