In France, non-resident companies often find it challenging to navigate the complex world of accounting and tax regulations. French accounting firms assist foreign companies and individuals in managing their financial affairs while conducting business in the country. These firms play a crucial role in ensuring compliance with French tax laws and regulations, helping with everything from obtaining a VAT number to submitting annual reports. This support is essential for foreign entities to fulfill their financial obligations in France.

This article explores the main aspects of accounting and tax compliance for non-residents in France and lays the foundation for how House of Companies has innovated and simplified French accounting.

France has a comprehensive legal framework governing financial reporting, primarily based on the French Commercial Code (Code de Commerce) and the General Chart of Accounts (Plan Comptable Général or PCG). This framework is supplemented by regulations from the French Accounting Standards Authority (Autorité des Normes Comptables or ANC) and, for listed companies, International Financial Reporting Standards (IFRS) as adopted by the EU.

Entities with securities listed on a regulated market in the EU/EEA must comply with additional reporting requirements under the Financial Security Law (Loi de Sécurité Financière). These requirements include publishing annual financial reports within four months of the end of the financial year and half-yearly financial reports within three months after the first six months of the financial year.

The annual financial reporting comprises the management report, audited financial statements, other information, and statements made by the management attesting to the true and fair view presented by the financial statements and management report.

For corporate tax purposes, a French company with substance, i.e., a permanent establishment (PE), is subject to corporate income tax (Impôt sur les Sociétés or IS) on its worldwide income. In contrast, a non-resident company without a PE in France is only liable for IS on French-source income, such as profits from a PE or income from French real estate.

The term 'permanent establishment' is defined in the French Tax Code (Code Général des Impôts) and follows the definition in the applicable tax treaty for treaty situations. For non-treaty situations, the definition aligns with Article 5 of the OECD Model Convention.

Regarding value-added tax (TVA in French), a French company with substance must register for TVA and charge TVA on its supplies of goods and services. A non-resident company without a PE in France may still be required to register for TVA if it makes taxable supplies in France, such as distance sales or e-services to non-TVA registered customers.

Dutch accounting regulations are governed by a robust framework designed to ensure transparency, accuracy, and compliance for both local and foreign businesses operating in the Netherlands. Key regulations include strict bookkeeping requirements, timely filing of annual financial statements, and adherence to corporate tax obligations.

Businesses must maintain detailed records of all financial transactions and prepare their accounts according to Dutch Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the company’s size and structure. VAT compliance is also essential, with regular filings required for both domestic and international transactions.

Corporate income tax filings are mandatory, with specific rules governing deductible expenses, participation exemptions, and tax credits. Non-compliance with these regulations can lead to penalties, making it essential for businesses to stay updated on Dutch accounting standards.

By adhering to Dutch accounting regulations, companies can ensure smooth operations, avoid legal issues, and benefit from favorable tax treatments available under Dutch law.

Businesses engaged in TVA taxable transactions in France are required to register for a French TVA number. This applies to both resident and non-resident companies supplying goods or services within the country. The registration process involves submitting an application to the French tax authorities (Direction Générale des Finances Publiques or DGFiP).

House of Companies has automated the process of obtaining a TVA number through our eBranch portal, simplifying this crucial step for our clients.

Businesses engaged in TVA taxable transactions in France are required to register for a French TVA number. This applies to both resident and non-resident companies supplying goods or services within the country. The registration process involves submitting an application to the French tax authorities (Direction Générale des Finances Publiques or DGFiP).

House of Companies has automated the process of obtaining a TVA number through our eBranch portal, simplifying this crucial step for our clients.

Resident companies in France are subject to corporate income tax (IS) on their worldwide income. The standard corporate income tax rate is 25% as of 2022. Companies must file annual corporate income tax returns and make advance payments throughout the year.

Non-resident companies are liable for corporate income tax only on their French-source income, such as profits attributable to a permanent establishment in France.

House of Companies provides comprehensive support for corporate tax compliance, helping both resident and non-resident companies navigate the complexities of French tax law.

To sum up, non-resident companies doing business in France need to navigate French accounting services and tax compliance. This article has looked at key areas like corporate income tax, bookkeeping rules, and legal entity types.

The intricate nature of French accounting rules underscores how crucial it is to get expert help to follow the rules and avoid potential penalties. When non-resident companies stay up-to-date on their tax obligations and due dates, they can remain in good standing with French authorities and focus on their core business activities.

House of Companies offers innovative solutions to simplify French accounting and tax compliance:

Automated TVA registration through our eBranch portal

Comprehensive support for employer registration and payroll compliance

Expert assistance with corporate tax filings and ongoing compliance

Guidance on choosing the most suitable legal entity structure for your business in France

To save on accounting costs with our software solutions and to request a demo or draft of financial reports, contact House of Companies. Our team of experts is ready to help you succeed in the French business landscape while ensuring full compliance with local regulations.

Non-resident entities operating in France are subject to various bookkeeping and financial reporting obligations under French law. These requirements are primarily governed by the French Commercial Code (Code de commerce) and the French Generally Accepted Accounting Principles (French GAAP or Plan Comptable Général).

Almost every corporate entity in France is required to prepare financial statements according to the law, usually incorporated in the entity's statutes. The financial statements serve as an essential element for the French legal system and form the basis for corporate governance. They are also relevant for taxation, as they serve as the starting point for determining the taxable basis, although tax laws have independent rules.

House of Companies Support: We assist non-resident entities from both EU and non-EU countries in navigating French accounting regulations, ensuring compliance with local requirements while optimizing financial reporting processes.

French financial statements generally must contain:

The financial statements should accurately reflect the company's financial position, and the accounting principles used must be set out in the financial statements. These principles, once implemented, may only be changed if there are good reasons for such a change, and the reasons and effect on the company's financial position must be disclosed in the notes.

House of Companies Support: Our team of experts assists in preparing comprehensive financial statements that comply with French GAAP, ensuring accuracy and transparency in financial reporting.

In France, parent companies are generally required to include the financial data of controlled subsidiaries and other group companies in their consolidated financial statements. This requirement is governed by the French Commercial Code and specific regulations issued by the French Accounting Standards Authority (Autorité des Normes Comptables, ANC).

Consolidation may be omitted under certain conditions, such as when the subsidiary or group company meets the criteria for being described as a small company for French statutory purposes or when the financial information has been included in the parent company's consolidated financial statements prepared per EU regulations.

House of Companies Support: We provide guidance on consolidation requirements and assist in preparing consolidated financial statements that comply with French regulations.

In France, audit requirements are determined by company size and legal structure. According to the French Commercial Code, companies exceeding certain thresholds are legally obliged to have their annual financial statements audited by an independent, qualified, and registered French auditor (Commissaire aux Comptes).

The auditor's report must include whether the financial statements provide information under the accounting principles generally accepted in France and accurately represent the financial position and result for the year.

House of Companies Support: We assist clients in determining their audit requirements and can recommend qualified French auditors when necessary. We also help in preparing for audits and addressing any issues raised during the audit process.

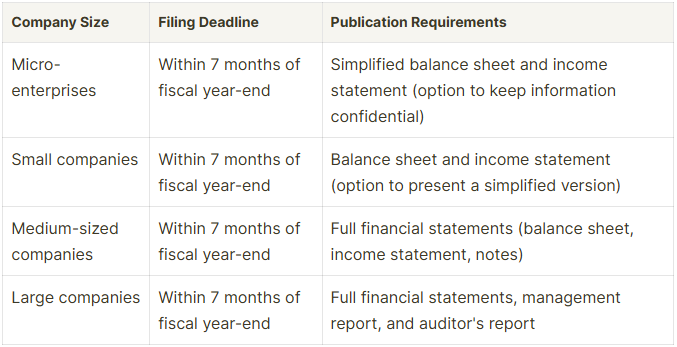

In France, financial statements must be prepared and approved by the managing directors within six months after the end of the financial year. The publication requirements vary depending on the company's size and legal structure.

Companies are required to file their annual accounts with the Registry of the Commercial Court (Greffe du Tribunal de Commerce) within one month of their approval by the shareholders.

House of Companies Support: We ensure timely preparation and filing of financial statements with the relevant French authorities, helping clients avoid penalties for late submissions.

Companies are required to prepare and file their annual accounts within specific deadlines. The financial statements must be prepared and approved by the managing directors within six months after the end of the financial year. Companies are then required to file their annual accounts with the Registry of the Commercial Court (Greffe du Tribunal de Commerce) within one month of their approval by the shareholders.

The publication requirements vary depending on the company's size and legal structure:

Notes:

Micro-enterprises: Annual turnover ≤ €350,000 (trade) or €175,000 (services)

Small companies: Meet at least 2 of these criteria: Balance sheet total ≤ €4 million, Net turnover ≤ €8 million, Average number of employees ≤ 50

Medium-sized companies: Meet at least 2 of these criteria: Balance sheet total ≤ €20 million, Net turnover ≤ €40 million, Average number of employees ≤ 250

Large companies: Exceed at least 2 of the medium-sized company thresholds

House of Companies Support: We ensure timely preparation and filing of financial statements with the relevant French authorities, helping clients avoid penalties for late submissions. Our expert team is well-versed in the specific requirements for each company size and can guide you through the process, ensuring full compliance with French regulations.

Foreign businesses operating in France must comply with French VAT regulations. The French Tax Code (Code Général des Impôts) governs the VAT obligations for non-resident entities.

Non-resident companies can choose to become resident for VAT purposes by opening a local office or recruiting local staff. Alternatively, they can maintain their non-resident status and appoint a fiscal representative in France.

House of Companies Support: We offer comprehensive VAT compliance services, including registration, return filing, and liaison with French tax authorities. We also advise on the most suitable VAT structure for your business operations in France.

Non-resident entities operating in France can choose to prepare their financial statements under either French GAAP or International Financial Reporting Standards (IFRS) as adopted by the European Union, depending on their specific circumstances and requirements.

French GAAP is based on the Plan Comptable Général (PCG) issued by the French Accounting Standards Authority (ANC). IFRS, on the other hand, is a set of international accounting standards widely recognized globally.

House of Companies Support: We provide expert guidance on choosing between French GAAP and IFRS, considering factors such as company size, industry, and international operations. Our team assists in implementing the chosen standards and ensures ongoing compliance.

In France, dividends paid by French resident corporations are generally subject to a 30% withholding tax (WHT) as per Article 119 bis of the French Tax Code (Code général des impôts).

However, dividends may be exempt from WHT under certain conditions:

A foreign company with a branch in France is not required to prepare separate French financial statements. However, the branch must maintain accounting records for tax purposes.

As a branch is not a separate legal entity, there are generally no withholding tax consequences for transactions between the head office and the branch. However, a branch tax (imposition forfaitaire annuelle) may apply to certain profits deemed distributed by the branch.

Under French accounting standards (Plan Comptable Général), parent companies should generally include the financial data of controlled subsidiaries in their consolidated financial statements.

A "controlled subsidiary" is typically defined as an entity in which the parent company:

Dividend payments received from a subsidiary should be recorded as financial income (produits financiers) on the parent company's profit and loss account. The corresponding receivable should be recorded on the balance sheet until the payment is received.

Outgoing dividend payments to shareholders should be recorded as a reduction in retained earnings (report à nouveau) on the balance sheet, with a corresponding liability (dividendes à payer) recorded until the payment is made.

According to French commercial law, the management board must prepare the financial statements within three months after the end of the financial year. This period can be extended by an additional three months under special circumstances if approved by the general meeting.

The financial statements must be approved by the general meeting within six months after the end of the financial year.

If the financial statements are not approved within this timeframe, the management board must disclose this fact to the Trade Register, along with the reasons for the delay and the expected date of approval.

Once the financial statements have been approved, they must be filed with the Trade Register within one month. The filing must include:

If the general meeting has not approved the financial statements, the management board must still file the prepared financial statements within two months after the due date for approval, accompanied by a statement indicating that the financial statements have not yet been approved.

Failure to comply with the filing requirements can result in penalties under French commercial law. The management board members may be held personally liable for any damages suffered by third parties as a result of non-compliance with the filing requirements.

To ensure compliance with French accounting regulations, non-resident entities should be aware of the annual reporting deadlines and filing requirements and seek professional advice when necessary.

The audit requirements for companies in France are determined by their size category. The size criteria are based on three factors: the value of the balance sheet assets, net turnover, and the number of employees. If a company meets at least two out of the three criteria for a specific category in two consecutive years (or the first year for newly formed companies), that category applies.

The table below summarizes the size criteria for each category:

Under French law, only medium-sized and large companies are legally required to have their financial statements audited by an independent, qualified, and registered French auditor.

Micro and small-sized entities are exempt from this requirement, and un-audited financial statements suffice for these smaller companies.

The auditor, appointed by the general shareholders' meeting or, in case of default, by the supervisory or managing board, must provide an auditor's report that includes an assessment of whether the financial statements provide information in accordance with the accounting principles generally accepted in France and accurately represent the company's financial position and results for the year.

Non-resident entities operating in France should be aware of these audit thresholds and requirements to ensure compliance with French regulations. Consulting with legal and accounting professionals can help determine the appropriate course of action based on the company's size and specific circumstances.

What does the CFC rule entail in France?

French tax law includes the Controlled Foreign Company (CFC) rule to prevent the participation exemption for entities with a majority stake (over 50%) in a foreign subsidiary or permanent establishment. This rule applies to those with specific types of passive income in a place considered low-taxed and on France's blacklist.

What are the French accounting standards?

French company law and statutory regulations shape the French accounting standards. These rules govern individual and consolidated financial statements, plus management board reports. The French Commercial Code outlines these standards.

Who qualifies as a non-resident taxpayer in France?

Non-resident taxpayers in France include people who don't live in France but reside in another EU country, Liechtenstein, Norway, Iceland, Switzerland, or other specified territories.

Is it necessary to hire an accountant in France?

No, there is no legal requirement to work with a (local) accountant. French bookkeepers can support without obtaining any specific license, or you can do your books yourself! However, getting help from a tax advisor can help you avoid problems later. Tax Advisors, and sometimes Accountants, can guide you to pick the most tax-friendly business structure and suggest other money-saving strategies to get the most out of your business.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!