At House of Companies, we are delighted to offer our clients the most comprehensive and cutting-edge bookkeeping services available in France. Our team of experts is equipped with the latest tools and technologies, enabling us to deliver innovative solutions tailored to meet your unique needs in the French market. With advanced and next-level support, you can rest assured that your bookkeeping needs are in the best possible hands, fully compliant with French regulations.

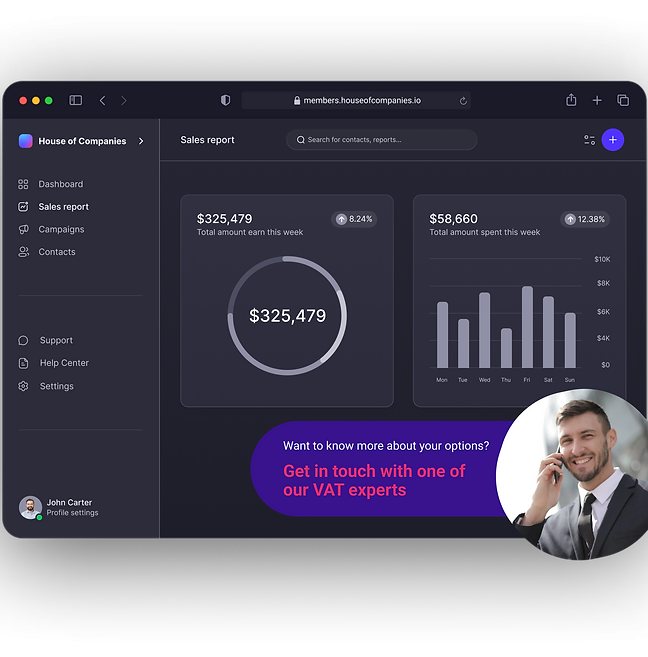

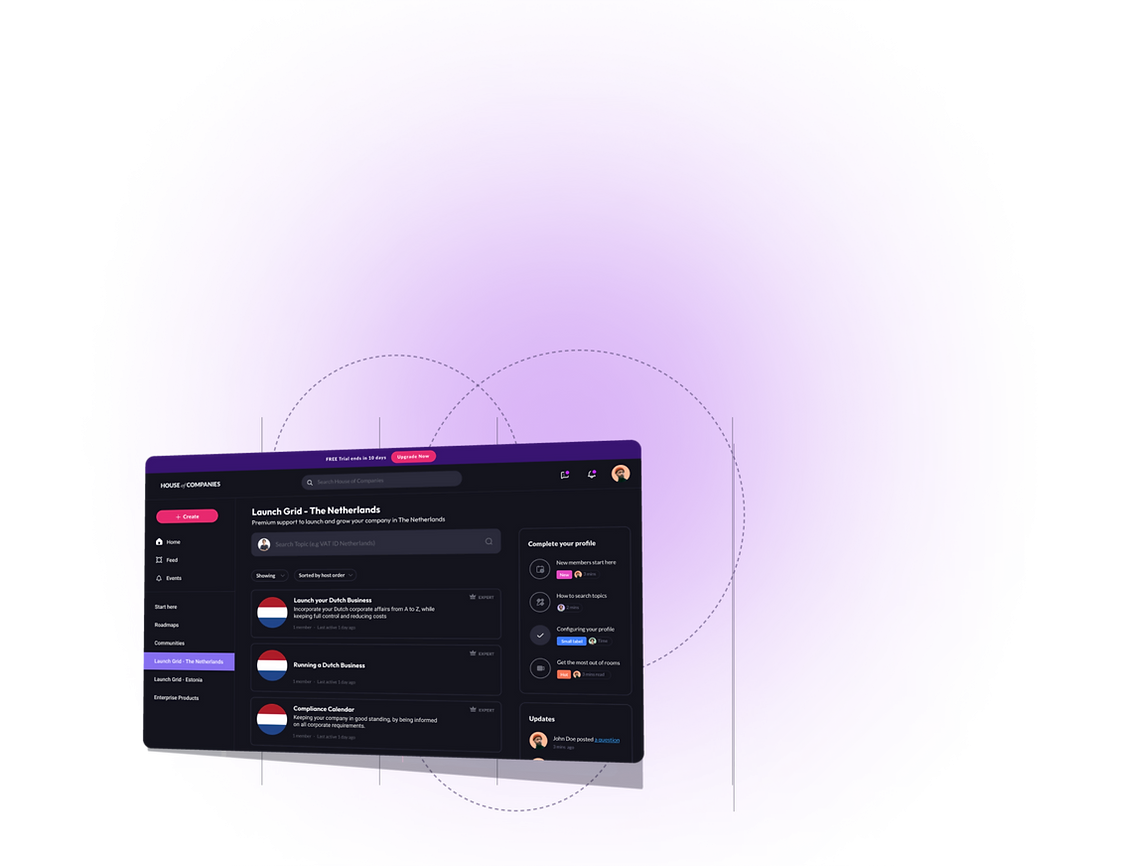

Delivering and processing invoices, bank statements, and agreements (such as your lease) has never been simpler. House of Companies simplifies the submission of your data using a single source for all documents, data, and reports. You can track our progress and your profits in real-time!

The process of submitting and processing invoices, bank statements, and even agreements (such as your lease) is becoming simpler every day.

House of Companies simplifies the procedure of submitting your data using a single source for all documents, data, and reports. You can track our progress and your profits in real-time!

We assist with VAT registration in France, which is mandatory for businesses with an annual turnover exceeding €82,800 for goods and €33,200 for services. Our experts ensure you're compliant with the French tax authority (Direction Générale des Finances Publiques).

We help navigate France's specific VAT rates: standard rate (20%), reduced rates (5.5% and 10%), and super-reduced rate (2.1%). Our team ensures your business applies the correct rates and follows proper invoicing procedures as per French law.

Our services include assistance with VAT recovery and refunds in France. We help you navigate the process of reclaiming VAT on business expenses, ensuring you maximize your entitlements within the French tax system.

We keep you informed about potential penalties and interest for non-compliance with French tax laws. Our proactive approach helps you avoid late filing fees, which can be up to 10% of the tax due, and interest charges of 0.2% per month.

Despite the ever-expanding nature of tax and accounting regulations, your situation may call for the assistance of a local tax professional. In France, a local accountant may be required by law in certain cases. If you need help filing your tax return, House of Companies is here to assist. You can either send us your existing ledgers and VAT Analysis or instruct us to draw up new ones from scratch.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!