What is the first step to starting a business in France?

The first step is to choose a unique company name and define your business's purpose and activities.What legal structure should I choose for my business?

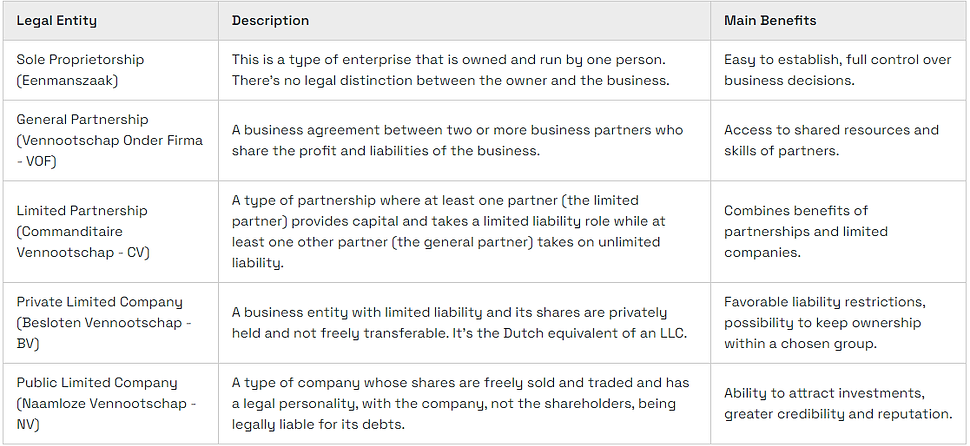

Common structures include Sole Proprietorship (Auto-Entrepreneur), Limited Liability Company (SARL), and Société par Actions Simplifiée (SAS). The choice depends on your business size, liability, and tax considerations.Do I need to register my business?

Yes, you must register with the French Chamber of Commerce (Registre du Commerce et des Sociétés - RCS) and obtain a business permit if required.What are the minimum capital requirements?

For most structures, there are minimal capital requirements; for example, €1 for SARL and SAS, but a higher amount may be advisable for credibility.Are there any specific permits or licenses I need?

It depends on your industry. Certain sectors, like food and construction, require additional permits. Always check local regulations.What are the tax obligations for businesses in France?

Businesses are subject to corporate tax, VAT, and social security contributions. Understanding your tax obligations is crucial for compliance.How do I hire employees in France?

You can hire employees through recruitment agencies, job portals, or direct postings. Ensure compliance with labor laws, including contracts and wage regulations.What protections are in place for employees?

France has strong labor laws, including a minimum wage, protection against dismissal, and mandatory paid leave. Familiarize yourself with these regulations.Can I get help with starting my business in France?

Yes, consulting firms like House of Companies offer services to assist with registration, compliance, and navigating the local business landscape.What is the process for protecting intellectual property in France?

You can protect your intellectual property by filing patents, trademarks, or copyrights with the French Intellectual Property Office.