Opening a bank account in France for your business is now accessible, quick, and entirely remote. Our specialized services streamline the account setup process, making it possible to open a business account without the need for physical presence or high fees. We handle all necessary documentation and adhere to French banking regulations, ensuring full compliance with the local legal framework.

Our expert team collaborates closely with top French financial institutions, guiding you through every step, from document verification to final approvals. This solution is perfect for international businesses looking to expand their reach in France and benefit from the convenience of a French bank account, all while remaining compliant with local laws.

Our banking solutions are tailored to support global expansion and efficient management of finances, with services crafted to meet French regulatory standards.

What We Offer:

Comprehensive Setup Support: We assist with documentation and ensure your bank account setup meets all French banking requirements.

Regulatory Compliance: Our team ensures that each step aligns with France’s banking regulations and local government guidelines.

Dedicated French Banking Specialists: Access expert guidance to simplify your bank account application and address all compliance requirements in France.

"Opening a business bank account in France seemed daunting at first, but the team made the process incredibly easy. They guided me through every step, ensuring all documentation was in order. I was able to complete everything remotely without any hidden fees. Highly recommend their services!"

Jane DCEO of Global Solutions

Jane DCEO of Global Solutions"The expertise and support provided were invaluable. I was impressed by how knowledgeable the team was about French banking regulations. They helped me navigate the complexities of compliance seamlessly. Thanks to their assistance, my company is now well-established in France!"

Mark TFounder of Tech Innovate

Mark TFounder of Tech Innovate"I had a fantastic experience using this service. The team was responsive and attentive to my needs. They took care of everything, from paperwork to setting up the account, and provided ongoing support afterward. I couldn’t have asked for a smoother process!"

Raj PCFO of WorldTrade Corp.

Raj PCFO of WorldTrade Corp.The complexities of opening and managing bank accounts in France requires specialized knowledge of French financial regulations. Our team of experienced professionals is here to simplify the process, ensuring that your banking needs are met seamlessly and in compliance with local laws. Here’s how we support your global banking journey in France:

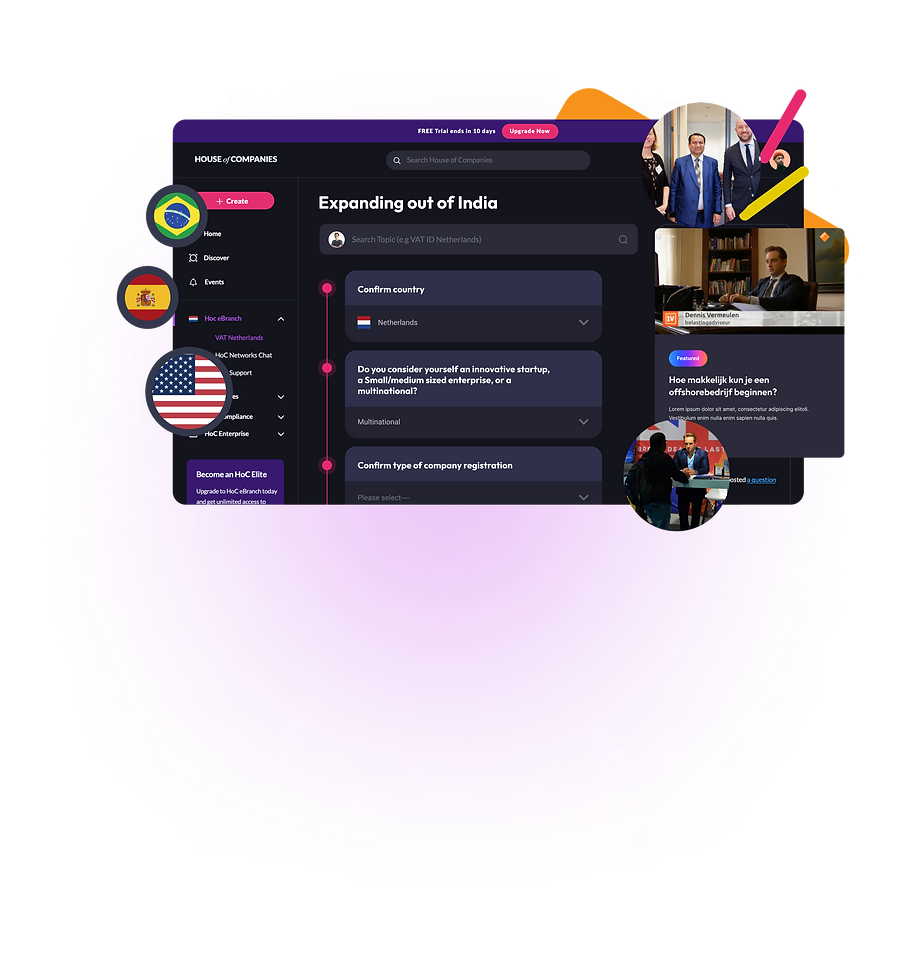

Entity management services worldwide with a focus on the Netherlands

Feel welcome, and try out our solutions and community,

to bring your business a step closer to

international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!