Welcome to House of Companies, where we simplify your financial processes and ensure your business remains compliant with local regulations. Our Annual Financial Statement service is tailored to meet the needs of businesses operating in France, offering a seamless and automated approach to bookkeeping and tax compliance. Our team of experts is well-versed in French tax regulations and is dedicated to helping you stay compliant.

Our automated bookkeeping service in France is designed to save you time and reduce errors. By leveraging advanced technology, we ensure that your financial records are accurate and up-to-date, allowing you to focus on growing your business.

Corporate tax in France is governed by a set of specific regulations that businesses must follow closely. Understanding these regulations is crucial for maintaining compliance and avoiding potential penalties that could arise from non-compliance. This overview will provide essential insights into the corporate tax landscape in France, helping businesses navigate their obligations effectively.

France employs a progressive corporate tax rate system, which means that the tax rates increase as a company's taxable income rises. The rates vary based on the company's taxable income, with specific thresholds and rates established by the French government. For instance, smaller companies may benefit from lower rates, while larger corporations face higher rates. This tiered approach aims to support small and medium-sized enterprises (SMEs) while ensuring that larger companies contribute a fair share to the national revenue. It is important for businesses to stay informed about any changes in these rates, as they can impact financial planning and overall profitability.

Taxable income in France encompasses all profits generated by the business, minus allowable deductions. This means that businesses must carefully track their income and expenses throughout the fiscal year. Allowable deductions can include costs related to operations, employee salaries, and other necessary expenditures. Accurately calculating taxable income is essential to determine the correct amount of tax owed. Businesses should maintain detailed records and consider consulting with tax professionals to ensure that they are maximizing their deductions while remaining compliant with tax laws.

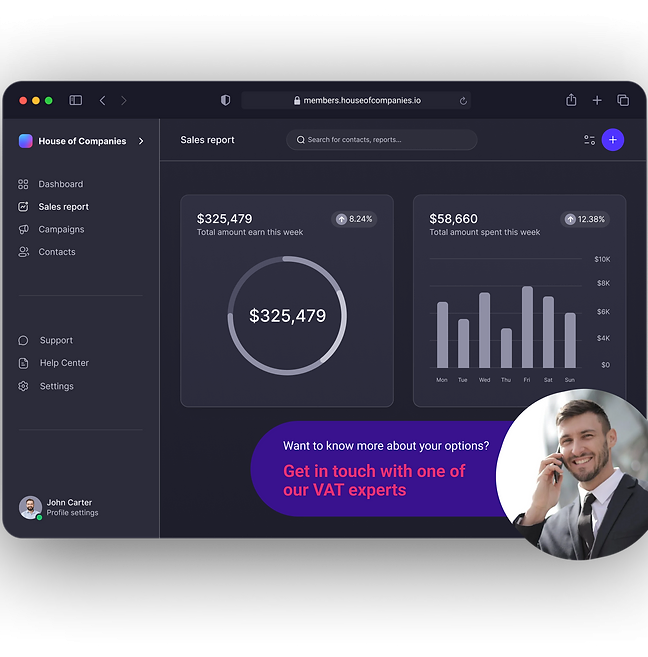

Businesses operating in France must adhere to strict tax compliance and filing requirements. This includes the timely submission of tax returns and the accurate reporting of financial information. Companies are typically required to file their corporate tax returns annually, and any taxes owed must be paid by the specified deadlines. Failure to comply with these requirements can result in significant penalties, including fines and interest on unpaid taxes. To assist businesses in meeting their obligations, organizations like the House of Companies offer services that ensure all tax obligations are met efficiently and accurately, helping to alleviate the burden of tax compliance.

France provides various tax incentives and credits designed to encourage business growth and investment. These incentives can significantly reduce a company's tax liability, making it easier for businesses to reinvest in their operations and support their financial health. For example, certain research and development (R&D) activities may qualify for tax credits, allowing companies to offset some of their expenses. Additionally, businesses that invest in specific sectors or regions may also benefit from reduced tax rates or other financial incentives. Understanding and leveraging these opportunities can be crucial for businesses looking to enhance their competitiveness in the market.

Transfer pricing regulations in France require businesses to document and justify the pricing of transactions between related entities, such as subsidiaries or parent companies. These regulations are in place to ensure that transactions are conducted at arm's length, meaning that they reflect fair market value. Compliance with these regulations is essential to avoid penalties and ensure fair taxation. Companies must maintain thorough documentation to support their pricing strategies and be prepared for potential audits by tax authorities. By adhering to transfer pricing regulations, businesses can mitigate risks and ensure that they are operating within the legal framework established by the French government.

House of Companies provides comprehensive support through our International Tax Officers. They offer personalized guidance and ensure that your business complies with all French tax regulations.

"Expanding to the EU was a breeze with House of Companies. Their automated bookkeeping and tax compliance services are top-notch!"

Amazon Trader

Amazon Trader"House of Companies has transformed our financial management. Their expertise in French tax regulations is invaluable."

Startup Founder

Startup Founder"I highly recommend House of Companies for their efficient and reliable services. They make tax compliance easy."

International Business Owner

International Business Owner

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!