Filing for the One Stop Shop (OSS) scheme in France simplifies VAT compliance for eCommerce businesses selling goods and services across EU countries. This program allows businesses to report and pay VAT through a single portal, significantly reducing administrative burdens and enhancing efficiency. Our team of experts ensures that your OSS filings are accurate and timely, helping you focus on growing your business in the European market while remaining compliant with local regulations.

Filing for the One Stop Shop (OSS) scheme in France simplifies VAT compliance for eCommerce businesses.

This initiative allows sellers to report and pay VAT across the EU through a single portal.

By utilizing OSS, businesses can significantly reduce administrative burdens associated with multiple VAT registrations.

Our team of experts ensures accurate and timely OSS filings, helping you avoid costly penalties.

We also keep you updated on the latest VAT regulations, ensuring compliance with local laws.

Partner with us for streamlined OSS filing and focus on growing your eCommerce business in France.

Document Extraction And Data Validation

From Any Platform

Simplified VAT Compliance

Our service streamlines the VAT filing process, saving you time and reducing the risk of errors.

Centralized Reporting

You can report VAT for multiple EU countries through a single portal, simplifying your administrative tasks.

Expert Guidance

Our experienced team provides personalized assistance, ensuring you understand all requirements for OSS compliance in France.

Timely Filings

We guarantee timely submission of your OSS filings, helping you avoid penalties and interest charges.

Regular Updates

Stay informed with the latest changes in VAT regulations and compliance requirements in France and the EU.

Dedicated Support

Our customer support team is available to assist you with any questions or concerns regarding your OSS filings.

"We were overwhelmed by the complexities of VAT compliance across Europe. Thanks to the OSS filing service, we now manage our VAT obligations seamlessly from France. The team is knowledgeable and supportive, making the process smooth and stress-free!"

Sarah J.,Ecommerce Business Owner

Sarah J.,Ecommerce Business Owner"Using the Ecommerce OSS service has transformed how we handle our international sales. The clarity and guidance provided by the experts ensured we met all requirements, and I couldn't be happier with the results!"

John M., International Retailer

John M., International Retailer"The OSS filing service has been a game-changer for our eCommerce business. Not only did it simplify our VAT reporting, but it also saved us valuable time and resources. Highly recommended!"

Linda K.,Digital Marketing Specialist

Linda K.,Digital Marketing Specialist1. What is the Ecommerce OSS scheme in France?

The Ecommerce One Stop Shop (OSS) scheme simplifies VAT reporting for eCommerce businesses selling goods and services across the EU. It allows you to file VAT for multiple countries through a single portal in France.

2. Who is eligible for the OSS scheme?

Any eCommerce business selling goods or services to consumers in the EU can apply for the OSS scheme. This includes both EU-based and non-EU businesses.

3. How do I register for the OSS scheme in France?

To register for the OSS scheme, you must submit an application through the French tax authorities. Our team can assist you with the registration process to ensure compliance.

4. What are the deadlines for OSS filings in France?

OSS filings in France are typically due quarterly. It’s important to stay informed about specific deadlines to avoid penalties for late submissions.

5. Can I amend my OSS filings after submission?

Yes, you can amend your OSS filings if you discover errors. However, there are specific procedures and timeframes for making amendments, which our team can guide you through.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

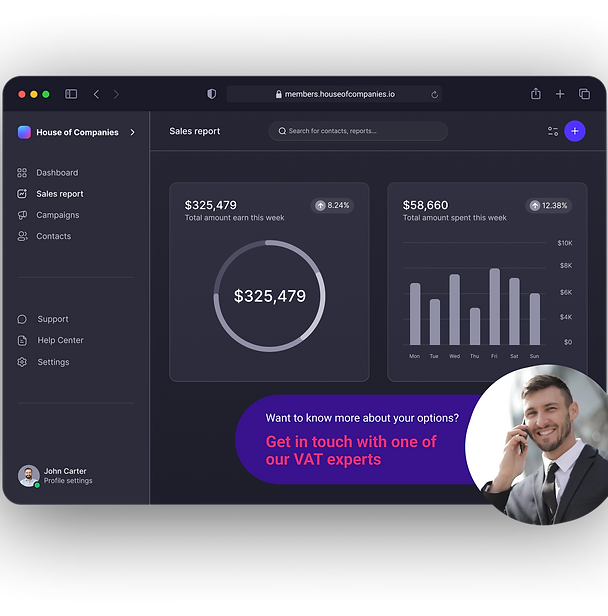

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!