House of Companies provides comprehensive Business Registration services across all EU States, including France.

Are you considering starting a business in France but worried about the complexities of online company formation? House of Companies offers efficient company formation services tailored to the French market. For those in urgent need, we also provide Shelf Companies and same-day formation services in France!

Are you planning to expand overseas by purchasing a readymade company? Branching out can be tricky and expensive. But our Entity Management has got you covered! Most European countries, and many more than that, allow you to register your current legal entity as a branch.

Try our Entity Management to register your branch or start your company, during a Free Trial.

Once your local branch is registered , you can use Entity Management to further run & grow your company!

Entrepreneurs can choose from several structures when starting a business in France:

SARL (Société à responsabilité limitée): Similar to a Limited Liability Company, suitable for small to medium-sized businesses.

SAS (Société par actions simplifiée): Flexible structure, popular among startups and foreign companies.

SA (Société anonyme): Ideal for larger companies, required for publicly traded companies.

The regulatory landscape in France requires careful planning, especially for non-residents. Here are some local regulations to keep in mind:

Timeframe & Costs: In France, business registration generally takes between 5 to 10 days. With costs often under €100 for basic registration, France’s streamlined process makes setup easy and affordable.

Online Registration: France allows for online registration through the government portal, reducing the need for a physical presence during setup.

Local Government Agency Involvement: Registrations are processed through the Centre de Formalités des Entreprises (CFE), ensuring that non-residents have a centralized point for all compliance-related submissions.

Documents Required: French law mandates documents including the company’s articles of association, details of directors and shareholders, proof of a registered address, and, for non-residents, a certified translation of required documents.

House of Companies offers tailored advice to help you select the optimal structure and navigate the specific legal and tax implications. With extensive experience across France and the EU, our consultants simplify the registration process for non-residents.

Some of the most popular regions for business registration in France include:

Paris: Known for its vast market access and international reputation, Paris is ideal for businesses in finance, technology, and services.

Lyon: A significant hub for manufacturing and industrial companies, Lyon offers a strategic location with direct links to other EU markets.

Marseille: This port city provides excellent opportunities for logistics and trade businesses seeking to access Southern Europe and North Africa.

Step 1: Initial Consultation

Our team provides a free consult to determine the ideal business structure, discuss compliance needs, and outline the registration process in France.

Step 2: Document Preparation

House of Companies assists with all necessary documentation, including articles of association, translation services for non-resident documents, and registration forms specific to France’s requirements.

Step 3: Submission via Online Portal

We guide non-residents through the French online registration system, ensuring swift and error-free submissions to the Centre de Formalités des Entreprises (CFE).

Step 4: Receiving Approval & Tax ID Assignment

Upon successful registration, the business will receive a SIRET number (identification number) and a VAT ID, essential for compliance and operational start-up.

France has specific compliance standards, which can be complex. House of Companies offers cost-effective legal support for non-residents, making compliance accessible:

Affordable Legal Assistance: Through our partnerships with local law firms, we offer discounted rates on legal consultations and compliance checks.

DIY Legal Platform: For those looking to reduce costs, our platform provides templates and DIY tools for managing compliance on your own.

France has specific compliance standards, which can be complex. House of Companies offers cost-effective legal support for non-residents, making compliance accessible:

House of Companies partners with local law firms in France to provide discounted legal consultations and compliance services. This makes it easier for non-residents to get the legal support they need at lower costs.

For non-residents who want to handle compliance tasks independently and save money, House of Companies offers a platform with tools and templates. This allows them to manage certain compliance requirements on their own, reducing the need for direct legal assistance.

"Dealing with local notary and deposit requirements was overwhelming. Registering my UK LTD in France was seamless with the support from Entity Management."

Trucking & Logistics

Trucking & Logistics"Starting a local business felt daunting, but I needed a French company number. The branch setup has been ideal!"

Bol.com Trader

Bol.com Trader"Outsourcing our staff led us to register in France, and Entity Management has been a fantastic partner for our needs!"

Recruitment & Payrolling

Recruitment & PayrollingRegistering a branch of your existing Limited Company may not always be the best solution in France. In our blogs and roadmaps, we outline the pros and cons of different options in each country to help you make the right choice.

If you decide that incorporating a local company is the way forward, House of Companies is here to assist with every step of the incorporation process.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

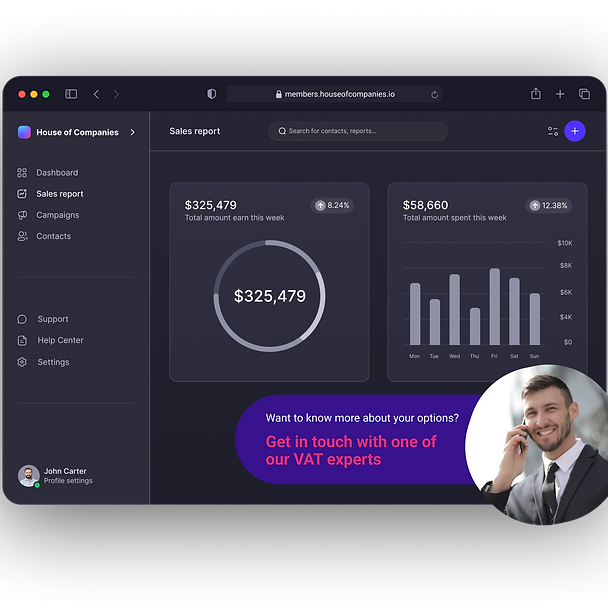

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!