Are you ready to unlock the potential of your business in France? Let us guide you through the intricacies of French accounting and tax regulations with our expert France Accounting Services.

France, the world's seventh-largest economy, offers a strategic location, robust infrastructure, and access to the European Single Market. But navigating its complex regulatory landscape can be challenging. That's where House of Companies steps in, offering tailored accounting solutions to help your business thrive in the French market.

Automated OSS filing for ecommerce and import traders.

Close your financial year, and prepare Financial Statements at a click of a button!

Automate your VAT filing in Croatia and simplify growth.

Ready to branch out to Croatia and beyond? Manage your entity and your growth!

At House of Companies, we understand that every business is unique. Our team of expert accountants and tax advisors is here to provide personalized support at every step of your journey in France. Whether you're a startup looking to establish a foothold or a multinational corporation expanding your operations, we have the expertise to guide you through the complexities of French business regulations.

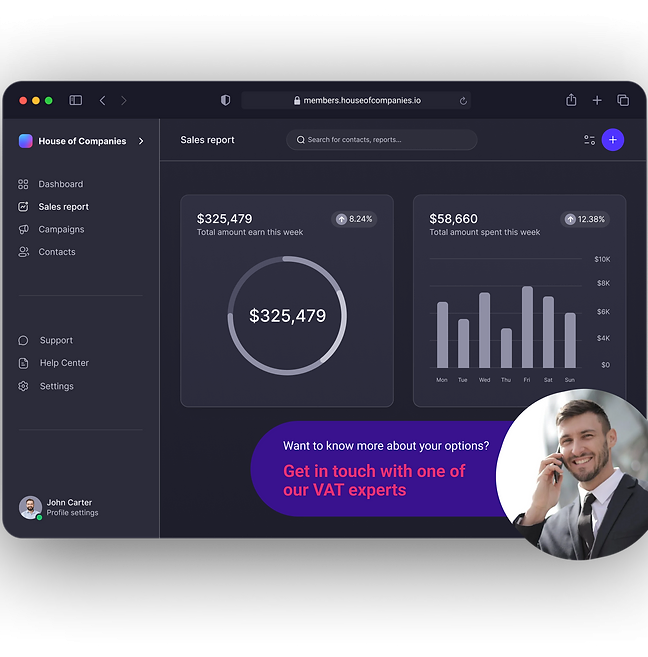

You can track our progress, and your profits, in real-time!

French accounting practices are governed by the Plan Comptable Général (PCG), overseen by the Autorité des Normes Comptables (ANC). For larger companies, International Financial Reporting Standards (IFRS) as adopted by the EU are applicable. Our team at House of Companies stays up-to-date with these regulations, ensuring your business remains compliant while maximizing financial opportunities.

We offer:

Expert guidance on PCG and IFRS implementation

Regular updates on changes in French accounting standards

Customized accounting solutions tailored to your business size and sector

A company with a permanent establishment in France is subject to corporate tax on its worldwide income. In contrast, non-resident companies are only taxed on French-source income. House of Companies can help you determine your status and optimize your tax strategy accordingly.

Our services include:

Assessment of your company's tax status in France

Strategic tax planning to minimize liabilities

Assistance with tax treaty applications

Companies with a permanent establishment must register for VAT and charge it on their supplies. Non-resident companies may still need to register for VAT if they make taxable supplies in France. Our experts can guide you through the VAT registration process and ensure compliance with French VAT regulations.

We offer:

VAT registration assistance

Ongoing VAT compliance support

Advice on VAT-efficient business structures

Non-resident entities looking to establish a presence in France have several legal entity options, each with specific accounting and tax implications. Our team at House of Companies can guide you in selecting the best structure for your business goals in France.

The most common types include branch offices (succursales), subsidiaries (filiales), and liaison offices (bureaux de liaison).

A Branch Office (Succursale) is not a separate legal entity but an extension of the foreign parent company. It must be registered with the French Commercial Court and is subject to corporate income tax and VAT on profits generated within France. While branch offices are not required to file separate financial statements in France, the parent company's financial statements must be provided.

Subsidiaries (Filiales), by contrast, are independent legal entities incorporated under French law. They must register with the Commercial Court, file annual financial statements, and fulfill all French tax obligations, including corporate income tax, VAT, and payroll tax. Subsidiaries offer greater administrative autonomy and a clear distinction from the foreign parent company.

Liaison Offices (Bureaux de liaison) serve as non-commercial offices that carry out promotional or preparatory activities. Liaison offices do not generate revenue or conduct business operations, making them exempt from corporate tax obligations.

Non-resident entities conducting business in France must adhere to local tax registration requirements, including registration for VAT, payroll taxes, and corporate income tax, depending on the nature and scope of their activities in the country. House of Companies provides comprehensive support for all tax compliance obligations in France, ensuring a smooth process from registration to ongoing compliance.

Businesses making VAT-taxable supplies in France are required to register for a French VAT number. The standard VAT rate in France is 20%, with reduced rates of 10%, 5.5%, and 2.1% applicable to certain goods and services. Our team assists with VAT registration and helps manage all VAT-related obligations, including the preparation and filing of VAT returns and advice on VAT-efficient practices. Non-resident companies may need to appoint a fiscal representative to handle VAT compliance on their behalf.

If your business employs staff in France, it must register as an employer with relevant French social security bodies and comply with payroll tax obligations. Payroll tax includes wage tax, social security contributions, and employee insurance premiums, all of which must be withheld and paid to the French authorities.

House of Companies offers a complete payroll service, ensuring your business meets French labor law requirements and properly manages social security contributions.

French resident companies are subject to corporate income tax on worldwide income, with a standard rate of 25% as of 2022. Small and medium-sized enterprises (SMEs) may qualify for reduced rates under certain conditions. Non-resident companies are taxed only on French-source income, such as profits attributable to a permanent establishment in France. Both resident and non-resident companies are required to file annual corporate tax returns, and advance tax payments may be required throughout the year.

Our team provides guidance on the French corporate tax system, offering strategies to optimize tax efficiency and assisting with corporate tax return preparation, filing, and support for tax audits or inquiries.

Non-resident entities operating in France must comply with specific bookkeeping and financial reporting standards governed by the French Commercial Code and Generally Accepted Accounting Principles (French GAAP). At House of Companies, we provide full-service bookkeeping and financial reporting assistance to ensure your records align with French requirements.

French companies, including non-resident entities, are required to prepare annual financial statements that reflect their financial health and operations. The standard financial statements include:

These statements form the foundation of corporate governance in France and are essential for tax compliance, as they serve as a basis for determining taxable income. Once an accounting principle is applied, it can only be modified if a valid reason is provided, with an explanation of the impact disclosed in the notes.

Our bookkeeping services include:

French regulations often require parent companies to consolidate financial information from subsidiaries or affiliated entities into unified group financial statements. This requirement applies when the parent company holds more than 50% of voting rights or exercises significant influence over the management of the subsidiary. Consolidated statements are critical for presenting a clear and comprehensive view of the group’s overall financial position and performance.

Situations Requiring Consolidation:

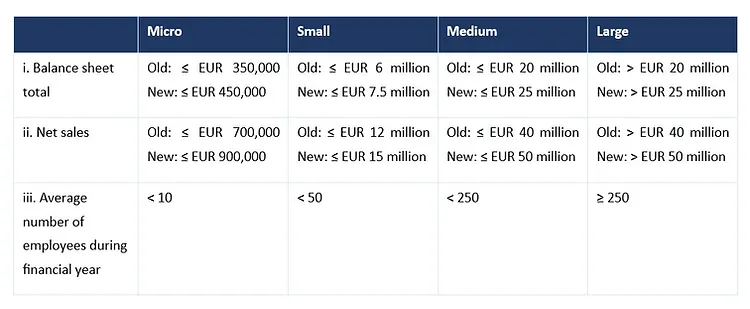

Certain entities in France must undergo an annual financial audit based on their legal form, size, and financial performance. An independent, registered French auditor must review the financial statements to verify their accuracy and compliance with French GAAP. Companies meeting specific thresholds, such as medium-sized and large corporations or those structured as public entities, generally fall under this requirement.

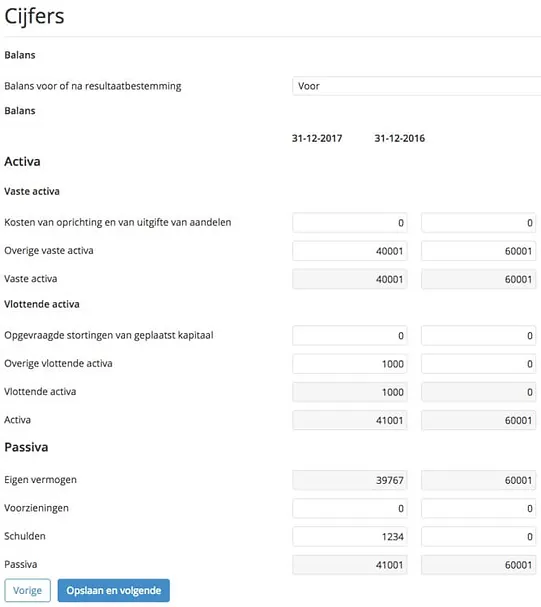

Thresholds for Mandatory Audit:

French entities, including non-resident companies with registered operations in France, must file their annual accounts with the local Commercial Court (Greffe du Tribunal de Commerce). This process, also known as publication, requires companies to submit their financial statements in a standardized format by specific deadlines to ensure public accessibility and regulatory compliance.

Key Filing Details:

Operating a non-resident entity in France involves more than just filing financial statements. Companies must ensure they meet all tax obligations, including VAT, corporate income tax, and payroll taxes. House of Companies offers tailored solutions for ongoing compliance, helping your business maintain its good standing in France.

Under French law, most corporate entities are required to prepare and file annual financial statements that meet the French Commercial Code standards, establishing a foundation for corporate governance, legal compliance, and tax reporting. These financial statements also serve as the basis for calculating the taxable income, although specific tax laws operate independently from accounting standards.

Financial statements must be prepared and approved by the managing directors no later than six months after the conclusion of the financial year. Companies may request an extension for filing, although this is generally reserved for exceptional circumstances.

The publication requirements vary based on the company's size and legal structure, ensuring transparency and compliance with French regulations. Failure to comply with these obligations can result in penalties and legal repercussions, emphasizing the importance of adhering to all relevant deadlines and requirements.

In today's fast-paced business environment, online bookkeeping services have become essential for companies looking to optimize their financial processes. These services provide a comprehensive suite of features designed to cater to the specific needs of startups and established enterprises operating in France. By harnessing advanced technology and professional expertise, online bookkeeping providers ensure accurate financial reporting and efficient management of financial records.

The proficiency of the virtual bookkeeping team is critical in determining the quality of the service provided. Many firms in France employ qualified bookkeepers who understand the unique challenges posed by local regulations and various industries, including e-commerce.

These experts are often certified in widely used cloud accounting software such as Sage or QuickBooks and have experience with specialized applications tailored for the French market. Their expertise enables them to implement technology solutions that streamline accounting for marketplace transactions and platform payouts, all while ensuring compliance with French accounting standards.

The pricing for virtual bookkeeping services can vary considerably based on the model chosen by the business. Understanding these pricing structures is essential for making informed financial management decisions. Common models include:

Factors influencing pricing include the scope of services offered, the geographic location of the business, and the level of customization required. Businesses should be cautious of potential hidden costs and seek providers that offer scalable pricing options.

Online bookkeeping services typically offer a wide range of features designed to effectively support businesses in France, including:

Advanced features may also include inventory valuation services, control account reconciliations, and support for VAT returns compliant with French regulations. Many providers offer cloud-based solutions, providing businesses with 24/7 access to their financial data while implementing robust security measures to protect sensitive information.

By selecting the appropriate online bookkeeping service, businesses in France can enhance their operational efficiency, improve accuracy, and gain valuable insights into their financial health, allowing them to concentrate on core business functions while ensuring their financial matters are managed competently.

Industry-specific bookkeepers provide invaluable expertise that transcends basic accounting principles, equipped with a deep understanding of sector-specific regulations, tax implications, and financial best practices. Their specialized knowledge allows them to:

By effectively collaborating with a diverse range of stakeholders, from customers to senior management, industry-specific bookkeepers excel at managing complex relationships within the business ecosystem.

Virtual bookkeeping assistants have emerged as essential resources for businesses looking to optimize their financial management processes. These skilled professionals provide remote support, efficiently managing financial records, transactions, and reporting processes. By utilizing advanced accounting software and tools, virtual bookkeeping assistants handle a broad spectrum of tasks, from data entry and reconciliations to payroll processing and expense tracking.

Virtual bookkeeping assistants come equipped with extensive knowledge and skills. They possess a strong grasp of accounting principles and are proficient in various cloud accounting software platforms. Their expertise includes managing balance sheets, generating income statements, optimizing financial resources, and preparing tailored reports. Additionally, their ability to work with a diverse range of stakeholders, from customers to senior management, enables them to adeptly navigate complex relationships within the business environment.

Many virtual bookkeeping assistants have significant industry experience, with some having over a decade in the field. They engage in regular training to stay current on the latest accounting standards, tax regulations, and reporting requirements, ensuring that businesses receive accurate and compliant financial services.

The cost of hiring a virtual bookkeeping assistant can vary based on several factors, including their experience and the complexity of tasks. Common pricing models include:

For businesses seeking more consistent support, many virtual bookkeeping services provide monthly subscription plans that often come in tiers. These tiers allow companies to select the level of service that aligns with their needs and budget. Some providers offer flat rates for a predetermined number of hours per week or month, ensuring financial predictability.

It's worth noting that the location of the virtual assistant can also impact pricing. Assistants in regions with lower living costs may charge less than their counterparts in Western Europe, without compromising service quality.

Virtual bookkeeping assistants provide a comprehensive range of features designed to support businesses effectively, including:

By leveraging the expertise of industry-specific bookkeepers and virtual bookkeeping assistants, businesses in France can enhance their financial management processes, ensuring compliance, accuracy, and strategic decision-making.

Every business has unique needs. We work closely with you to understand your specific requirements and tailor our services accordingly. Whether you need basic bookkeeping or complex financial management, House of Companies has you covered.

Our process includes:

Initial consultation to understand your business

Customized service proposal

Regular reviews to ensure our services meet your evolving needs

Outsourcing your accounting to House of Companies can be more cost-effective than maintaining an in-house team. We provide access to expert knowledge without the overhead of full-time employees.

Benefits of outsourcing to us include:

Reduced operational costs

Access to a team of experts

Scalable services as your business grows

Expanding to a new market has never been easier. Our one-stop-shop portal simplifies your transition by handling everything from your new address and business setup to opening a bank account, obtaining a VAT ID, and becoming an employer, all in compliance with Croatian regulations and supported by local government agencies.

From A to Z, House of Companies provides guidance in your VAT registration registration, also for non-domestic companies.

Register your non-domestic company as employer in numerous EU countries, without hefty fees or local company formation!

Our subscription allows you to file tax returns directly at the local (online) Tax Portal, using the VAT analysis that we prepare. If needed we can submit on your behalf.

Register your non-domestic company as employer in numerous EU countries, without hefty fees or local company formation!

"Expanding my business to France was daunting, but the comprehensive support I received made it seamless. From securing a bank account to navigating VAT registration, every step was expertly handled!"

Marie DEntrepreneur

Marie DEntrepreneur"The one-stop-shop portal simplified everything for my startup. The team guided me through setting up my business and ensured I understood my employer responsibilities. Highly recommend!"

Julien LSmall Business Owner

Julien LSmall Business Owner"I was impressed with the personalized service and in-depth knowledge of the French market. Their assistance in obtaining my VAT ID and managing my accounts has been invaluable!"

Sophie TInternational Investor

Sophie TInternational InvestorSometimes, you need personalized advice. Our team of French tax advisors and accountants is ready to provide one-on-one support, ensuring your business navigates the complexities of French taxation and accounting with confidence.

Learn More →

Learn More →

Learn More →

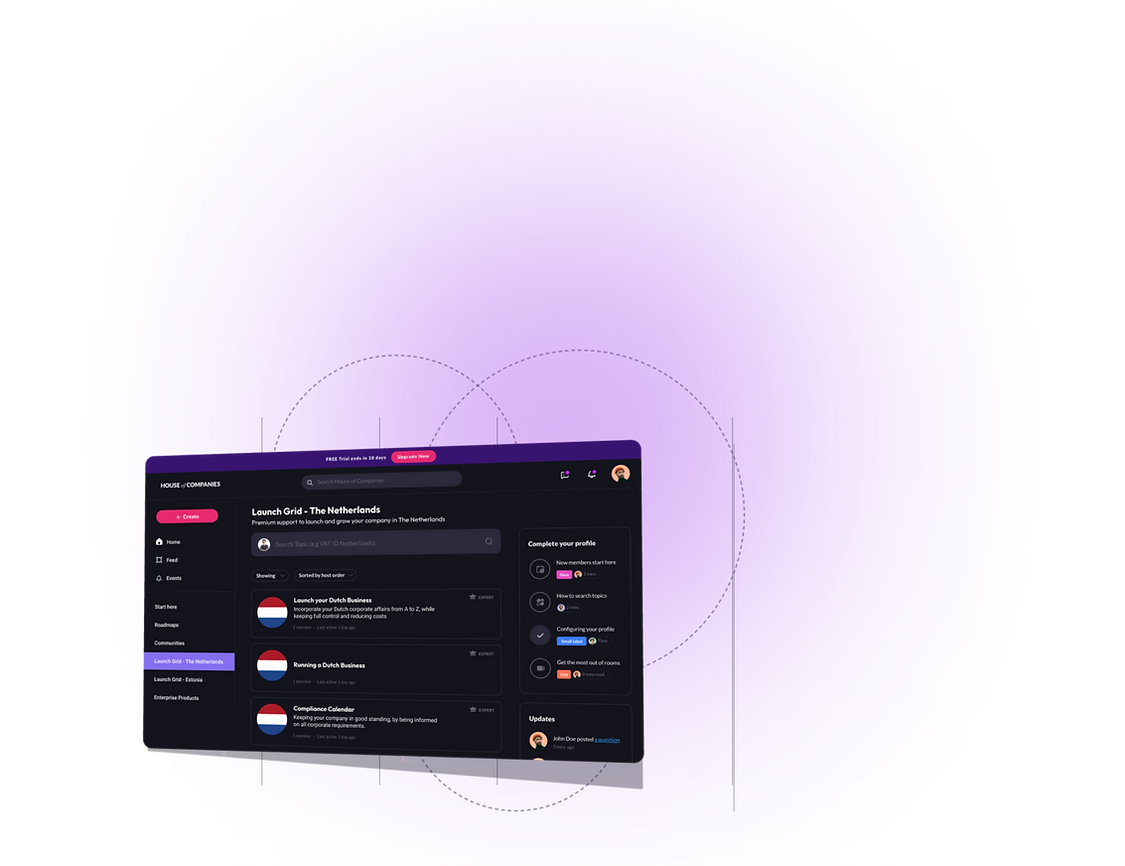

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!