Blockchain technology is revolutionizing legal business structures beyond financial transactions, introducing a new paradigm of transparency and decentralized ledger systems. The registration of SMART Companies on blockchain signifies a transformative era for legal entities, leveraging the trust, security, and efficiency inherent in this technology. Entrepreneurs can now envision the integration of tangible and intangible assets within immutable data blocks, aligning with House of Companies' vision to simplify and empower the international entrepreneurial journey.

SMART Companies on Blockchain are at the forefront of entrepreneurial innovation, reimagining trust, security, and transparency in business. These entities utilize blockchain's immutable ledger to strengthen trust through end-to-end encryption, fostering transparency with identical records distributed globally. The decentralized architecture of blockchain companies promotes an egalitarian network, while immutable records reduce costs and enhance security.

Recognizing the transformative potential of blockchain technology is crucial when considering how to start your SMART Company. It streamlines operations and redefines customer engagement through direct feedback loops, fostering rapid product iteration and innovation. House of Companies envisions a future where traditional business models are continually decentralized, prioritizing the autonomy of entrepreneurs.

Smart Company registration on blockchain technology is a savvy move for the modern entrepreneur. The process is quite straightforward, and with a sprinkle of innovation by House of Companies, it's available for any type of entrepreneur, even if you are still unfamiliar with blockchain or smart contracts. Here's how to get started

By following these steps, you'll have your Smart Company up and running on the blockchain in no time. In fact, companies like Proxeus and IBM Switzerland have demonstrated that this process can be completed in less than two hours, a testament to the efficiency of blockchain technology. Remember, it's not just about starting a business on blockchain technology; it's about pioneering a new era of corporate existence.

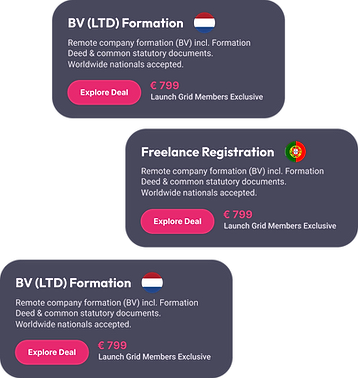

Entrepreneurs eyeing Smart Company registration should consider the global landscape, where jurisdictions are not created equal. The following locales stand out for their crypto-friendly climates and strategic advantages:

Estonia: A pioneer in digital governance, Estonia's regulatory framework for cryptocurrencies is well-established, with a clear taxation policy that doesn't apply VAT to Bitcoin and altcoins. The process for SMART company registration is efficient, with English and Russian as official languages for interaction with regulators. However, patience is required as the license application consideration can extend up to six months, accompanied by a state fee of 3,300 euros.

Singapore: Known for its robust economy and business-friendly environment, Singapore treats cryptocurrency as a commodity, with settlements seen as barter trade. Crypto companies must navigate a 7% goods and services tax but benefit from a supportive regulatory approach, requiring a license from the

Monetary Authority of Singapore (MAS).

Switzerland: The Crypto Valley offers a fintech license and AML compliance for legal cryptocurrency operations. Switzerland also provides a "sandbox" for businesses to test products and models without a license. Profits from digital asset operations are taxed according to Swiss law, maintaining the country's reputation for financial innovation.

Canada: With a registration valid for two years, Canada mandates crypto companies to register with FINTRAC as an MSB, ensuring compliance with financial regulations. Sellers of cryptocurrencies must report income on tax returns, reflecting Canada's structured approach to crypto businesses.

Malta: Despite a slow license issuance, Malta's tax regime is attractive, with an income tax of only 5%. The country offers various classes of crypto business licenses, albeit at a higher cost, positioning itself as a hub for blockchain enterprises.

British Virgin Islands and

Seychelles: Both jurisdictions provide strong infrastructure, a developed legal system, and high privacy levels for company owners, with no income or capital gains taxes on crypto enterprises. These offshore havens are ideal for those seeking confidentiality and tax advantages.

Saint Vincent and Grenadines: SVG supports blockchain technology without imposing taxes, offering a confidential environment for businesses.

Each jurisdiction has its unique blend of regulatory frameworks, tax policies, and support for blockchain technology, making them attractive destinations for Smart Company Formation.

Entrepreneurs should weigh these factors alongside their business needs to start a company on Ethereum or other blockchain platforms, ensuring a strategic and compliant entry into the crypto space.

Setting up a blockchain business in France? You'll want to get familiar with the legal stuff.

That's all about getting your papers in order and playing by the rules of the blockchain business game.

To set up a branch office (of an offshore SMART company, such as Delaware or Seychelles has to offer) in France, it's essential to follow certain rules for paperwork. Since the branch isn't its own legal entity, you can register it with the same legal structure as the parent company. This is done at the French Business Register (Registre du Commerce et des Sociétés - RCS).

Should the branch be deemed a permanent establishment, it must pay corporate tax and VAT. However, if it's providing support and not a permanent establishment, its tax situation would be different.

France offers a welcoming environment for blockchain companies boasting progressive policies and a tech-savvy scene. We've crafted a detailed guide that simplifies the process of establishing your blockchain company in this advanced economy ensuring compliance with French and EU regulations.

Business owners who make smart moves stand a good chance of thriving in the digital marketplace. If you're ready to launch your blockchain venture in France, think about seeking advice from professionals.

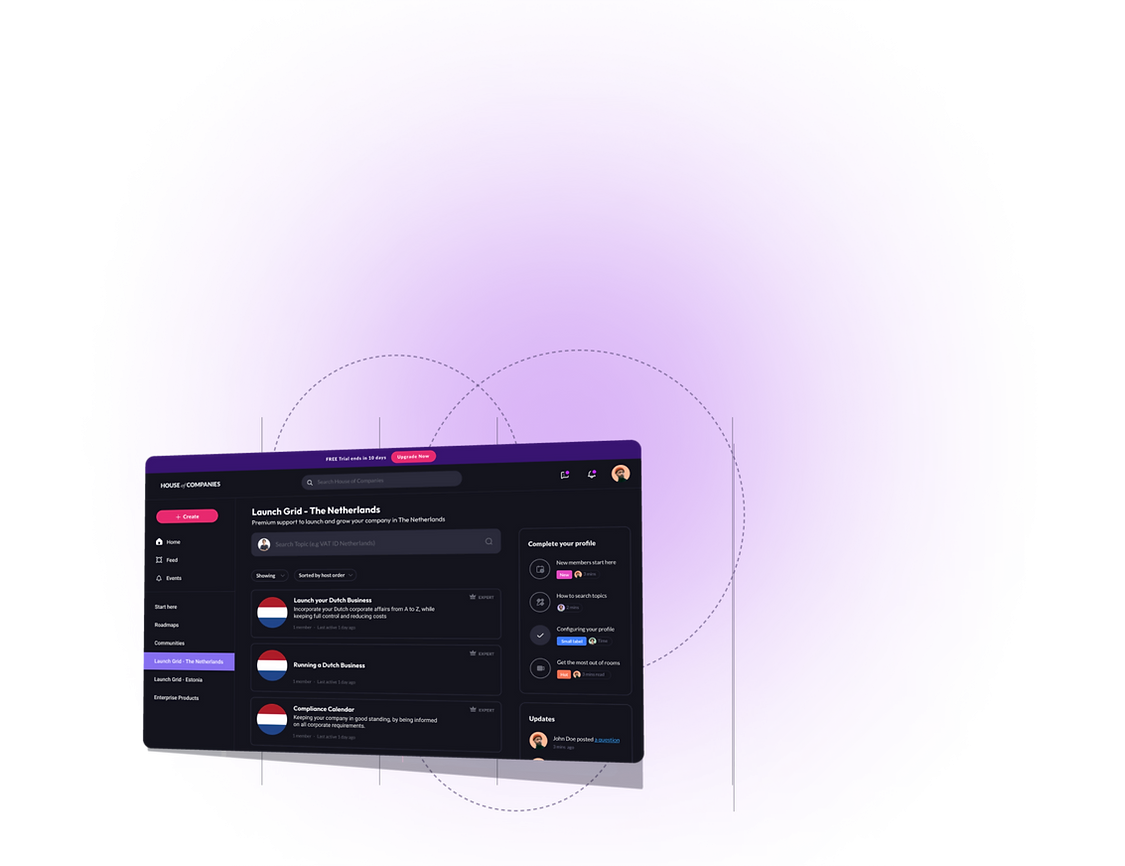

Are you considering starting a SMART Company or establishing a branch in France? Kick things off with a visit to House of Companies' website for a quick conversation. It's like unlocking a superpower for navigating the business world. By doing this, you're not launching a business; you're taking a strategic spot at the forefront of the digital wave, all set to leave your mark on the worldwide market.

Got your eye on a SMART Company or opening a French branch? Make sure to snag a consultation slot with House of Companies first. It's akin to having an ace up your sleeve when you enter the market. This move primes you for enduring triumph and influence on an international level.

1. Can you use blockchain technology in France?

In France, there are no specific laws that forbid using or trading cryptocurrencies. However, if you use crypto to make payments to others, this might be regulated by the Financial Services Act and the Payment Services Directive.

2. What's the best country to start a blockchain business?

If you're looking to launch a blockchain company, some of the top countries that are friendly to crypto businesses include Malta, which is famous for its forward-thinking legislations and tax benefits, along with Singapore, Portugal, Switzerland, Estonia, Germany, Slovenia, and Canada. These countries provide supportive environments that promote the growth of the blockchain industry.

3. Can you use cryptocurrency in France?

Indeed, residents in France can use cryptocurrencies like Bitcoin since there are no laws that forbid buying or trading digital currencies.

4. What's the method to trade cryptocurrency in France?

When trading crypto in France, you've got to take a few key steps. First, choose a trustworthy crypto exchange that adheres to French regulations. Next, create an account and confirm who you are. Deposit funds you want to use for trading, which can be done through options such as a bank transfer or a credit card.

Blockchain technology is not just a buzzword; it's a revolutionary force in the corporate world. SMART Companies, or blockchain-based legal entities, offer a suite of advantages over traditional corporations, making the concept of Smart Company registration not just innovative but also incredibly savvy for the forward-thinking entrepreneur. Let's unpack these advantages:

These advantages clearly depict why entrepreneurs are gravitating towards the idea of how to start your smart company and why jurisdictions like the Seychelles Smart Company and Hong Kong Smart Company are becoming hotspots for Smart Company Formation. It's not just about the ability to start a business on blockchain technology; it's about redefining what it means to be a company in the digital age.

"Dealing with local notary requirements was a hassle. I registered my UK LTD in France with the help of Entity Management."

Maria SEntrepreneur

Maria SEntrepreneur"I didn’t really want to start a local business…so confusing. But I needed a local company number. The branch works great!"

Maria SEntrepreneur

Maria SEntrepreneur"The outsourcing of staff required us to register in Germany. Entity Management is a perfect fit for us!"

Maria SEntrepreneur

Maria SEntrepreneurThe registration of a Smart Company might not be the best option for you. In our Blogs, and Roadmaps, we explain the Pro’s and Con’s in more detail for each country.

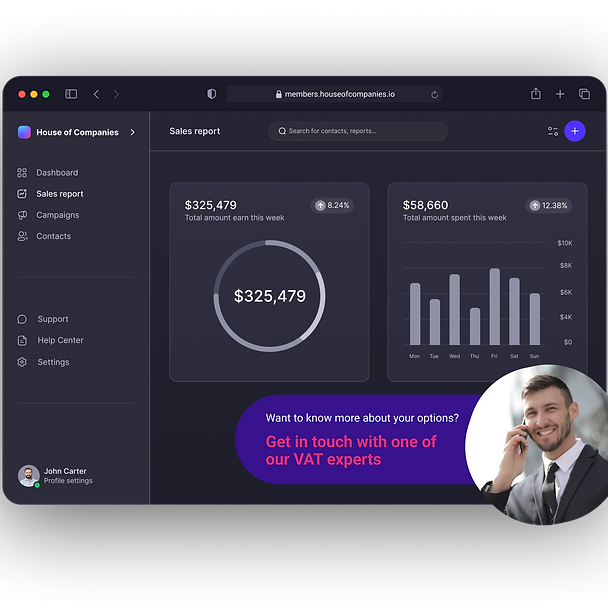

If you decide to incorporate a local company, House of Companies can assist you with the incorporation.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!